In today’s rapidly changing world, the concept of carbon footprint and personal finance has taken center stage. As we strive to lead meaningful lives, minimizing our environmental impact and managing our financial well-being have become intertwined. This comprehensive guide explores how our individual choices regarding personal finance can significantly influence our carbon footprint and, ultimately, shape a more sustainable future.

Table of Contents

Introduction to Carbon Footprint and Personal Finance

Understanding Carbon Footprint and Its Impact on the Environment

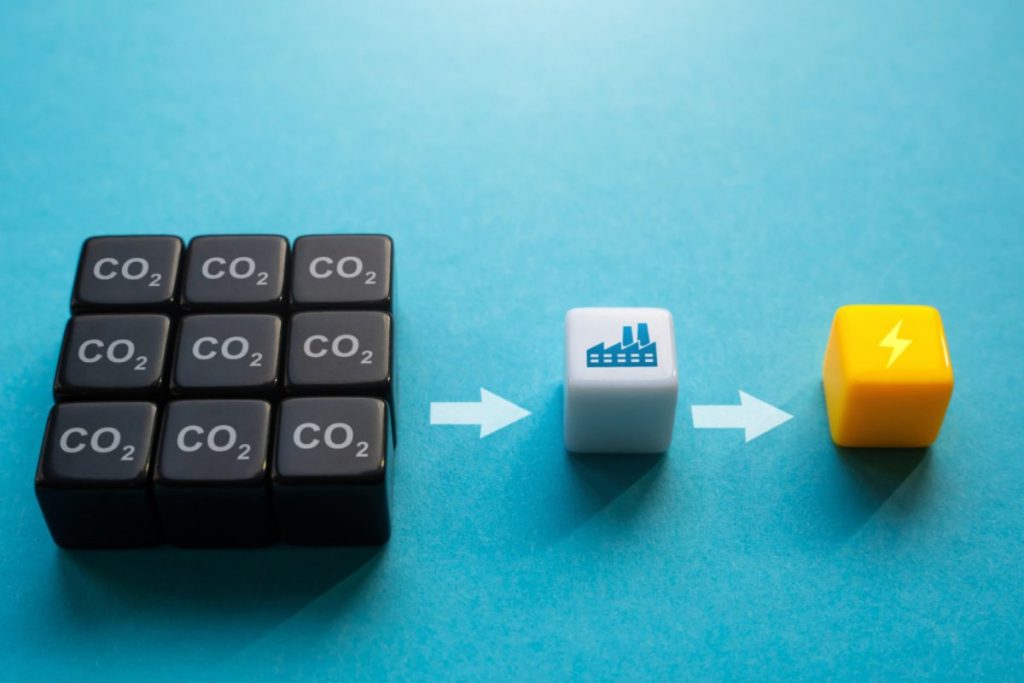

The carbon footprint represents the total amount of greenhouse gases, including carbon dioxide and methane, emitted into the atmosphere due to human activities. These emissions contribute to global warming and climate change, which pose severe threats to the planet’s ecosystems and inhabitants. Recognizing the significance of our carbon footprint is the first step towards adopting more environmentally conscious habits.

The Intersection of Personal Finance and Sustainable Living

Personal finance encompasses managing money, investments, and expenditures. It’s crucial to recognize how our financial choices directly impact our carbon footprint. Every decision, from the products we buy to the lifestyle we lead, has both a financial and environmental consequence. By making informed financial decisions, we have the power to reduce our impact on the environment while potentially saving money.

Calculating and Analyzing Your Carbon Footprint

Methods to Measure and Evaluate Individual Carbon Footprint

Calculating your carbon footprint involves assessing various aspects of your lifestyle, including energy consumption, transportation habits, diet, and consumption patterns. There are online tools and carbon calculators available that help estimate your carbon emissions based on data you provide. These calculations provide valuable insights into the areas where you can make a significant difference.

Financial Costs Associated with Carbon Emissions

Reducing your carbon footprint isn’t just about environmental responsibility; it also has financial implications. For example, using excessive electricity not only harms the environment but also results in higher utility bills. By understanding these financial costs, individuals can make conscious decisions to reduce both their carbon footprint and expenses.

The Role of Personal Finance in Environmental Impact

How Financial Choices Contribute to Carbon Footprint

Our financial decisions often translate directly into our carbon emissions. Purchasing energy-efficient appliances and vehicles, supporting eco-conscious brands, and investing in sustainable businesses can significantly reduce our carbon footprint. These choices create a ripple effect, as environmentally responsible companies are often more inclined to adopt sustainable practices throughout their operations.

Identifying Opportunities for Positive Change

Every financial decision offers an opportunity for positive change. By considering the environmental impact of your choices, you can identify alternatives that align with your values. Opting for renewable energy sources, reducing single-use plastic consumption, and supporting companies with robust sustainability practices are practical steps towards minimizing your carbon footprint.

Sustainable Lifestyle Choices for Carbon Reduction

Energy-Efficient Home Upgrades and Their Financial Benefits

Investing in energy-efficient home upgrades isn’t just about reducing your carbon emissions; it also leads to tangible financial benefits. Upgrades such as improved insulation, energy-efficient appliances, and solar panels not only contribute to a greener planet but also result in long-term savings through reduced energy bills.

Eco-Friendly Transportation Alternatives and Cost Savings

Transportation is a significant contributor to carbon emissions. Choosing eco-friendly alternatives, such as public transportation, biking, walking, or carpooling, not only reduces your carbon footprint but also saves you money on fuel and parking expenses. Additionally, considering electric or hybrid vehicles further supports your commitment to sustainable living.

Investing in Eco-Friendly Financial Products

Green Investments and Their Potential Returns

Green investments involve allocating your funds to companies and projects that prioritize sustainability. These investments not only contribute to environmental protection but also offer the potential for attractive financial returns. As sustainable practices become increasingly vital, companies adopting these principles are likely to see growth and success.

Ethical Banking and Financing Options for Sustainable Projects

Ethical banking institutions and financial organizations prioritize investing in environmentally friendly initiatives. By choosing to bank with these institutions and exploring their financing options, you indirectly support sustainable projects that align with your values.

Budgeting for a Greener Future

Allocating Funds for Eco-Friendly Initiatives

Integrating sustainability into your budgeting strategy demonstrates your commitment to a greener future. Allocating funds specifically for eco-friendly choices, such as solar panel installations, energy-efficient appliances, and sustainable products, provides you with a clear path to reducing your carbon footprint.

Balancing Financial Goals with Environmental Responsibility

While financial goals are crucial, it’s equally important to integrate environmental responsibility into your budget. By balancing your financial aspirations with eco-conscious decisions, you can achieve both financial stability and a reduced carbon footprint.

Educating and Engaging in Sustainable Communities

Collaborative Efforts for Reducing Carbon Footprint

Communities play a crucial role in driving positive change. Engaging with sustainable communities, whether in person or online, provides a platform for sharing knowledge, exchanging ideas, and discovering practical tips for reducing your carbon footprint.

Financial Incentives for Participation in Environmental Initiatives

Many regions offer incentives to encourage individuals to adopt sustainable practices. These incentives, such as tax breaks for installing energy-efficient appliances or rebates for electric vehicle purchases, not only make eco-friendly choices financially appealing but also contribute to a cleaner environment.

Monitoring Progress and Long-Term Sustainability

Tracking Reductions in Carbon Footprint and Financial Impact

Regularly monitoring the progress of your carbon footprint reduction efforts provides valuable feedback on the effectiveness of your strategies. By observing the correlation between reduced carbon emissions and financial savings, you reinforce the positive impact of your choices.

Setting Future Goals for Continued Sustainable Living

Creating a sustainable lifestyle requires setting achievable goals and continuously seeking opportunities for improvement. Whether it’s decreasing energy consumption, exploring more ethical investment options, or supporting sustainable initiatives, setting specific targets ensures your journey towards carbon footprint reduction remains focused.

Personal Finance as a Catalyst for Change

Empowering Individuals to Drive Environmental Transformation

Individuals have the power to drive significant environmental transformation through their financial choices. By opting for sustainable alternatives and supporting eco-friendly initiatives, you actively contribute to a more sustainable future for yourself and generations to come.

Inspiring Others to Embrace Sustainable Practices

Leading by example has a profound impact. When you embrace sustainable practices in your personal finance decisions, you inspire friends, family, and colleagues to follow suit. Through shared experiences and knowledge, you magnify the positive influence on the environment.

Conclusion: Harmonizing Carbon Footprint and Personal Finance

In the intricate dance between carbon footprint and personal finance, lies the potential for profound change. Recognizing the symbiotic relationship between these seemingly separate spheres empowers individuals to create a lifestyle that benefits both their financial prosperity and the health of the planet.

Balancing economic aspirations with environmental stewardship isn’t merely attainable; it’s essential for the well-being of our planet and future generations. As you navigate the path towards sustainable living and financial wellness, remember that each decision resonates through the harmonious blend of personal finance and carbon footprint reduction. By harmonizing these elements, we pave the way for a world that thrives on sustainability and abundance.