In today’s intricate economic landscape, unemployment rates play a pivotal role in gauging the overall health and vitality of a nation’s economy. This article delves into the multifaceted aspects of unemployment rates, elucidating their significance, various influencing factors, and far-reaching consequences on both micro and macro levels.

Table of Contents

The Significance of Unemployment Rates

Exploring Unemployment Rates

Unemployment rates stand as a critical economic indicator, reflecting the percentage of individuals actively seeking employment but unable to secure jobs. Beyond mere percentages, these rates encapsulate the aspirations, opportunities, and economic dynamics of a society. They serve as a barometer of economic health, shedding light on the efficiency of labor markets and overall economic stability. A rising rate can signify labor market distress, while a declining rate often signals a thriving economy with increased consumer spending and business expansion.

Economic Indicators and Unemployment

Unemployment rates are interwoven with various economic indicators that collectively unveil the economic tapestry. Low unemployment often signifies a robust economy with strong consumer spending and healthy business activity. This can result in a positive feedback loop, where increased consumer spending fosters business growth and job creation. Conversely, high unemployment can indicate economic downturns, lower consumer spending, and reduced business expansion. As a result, policy-makers, economists, and stakeholders closely monitor these rates to make informed decisions.

Factors Influencing Unemployment

Macroeconomic Factors

Unemployment rates are shaped by macroeconomic variables, acting as a reflection of a country’s overall economic performance. When an economy contracts, demand for goods and services diminishes, leading to layoffs and job losses. Conversely, during periods of economic growth, businesses expand, generating new job opportunities. Furthermore, monetary policies, interest rates, and fiscal stimulus also impact these rates, revealing the intricate relationship between policy decisions and employment outcomes.

Industry-specific Factors

Unemployment is not uniform across industries. Certain sectors are more susceptible to unemployment due to seasonal fluctuations or technological advancements. Automation and outsourcing, for instance, can disrupt traditional labor markets, resulting in job displacements. Understanding these industry-specific nuances is vital for crafting targeted policies and reskilling initiatives to address changing job demands.

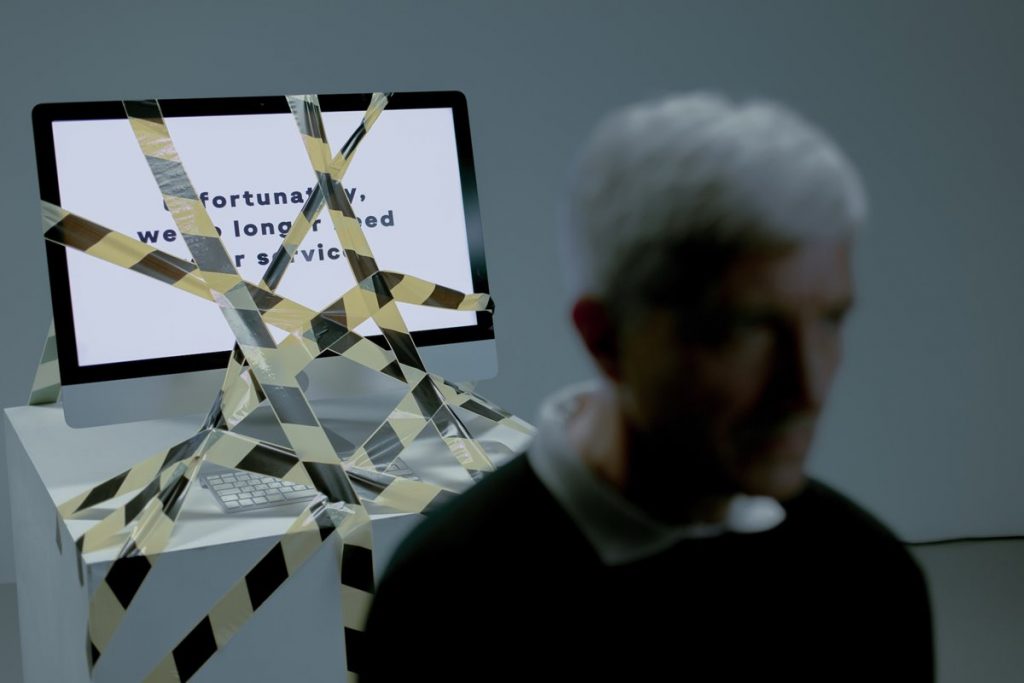

Technological Advancements

The rapid pace of technological advancements introduces a dynamic facet to unemployment rates. Automation and digitalization alter job requirements, rendering certain skill sets obsolete while creating demand for new skills. The resultant friction can lead to transitional unemployment as workers seek to align their skills with evolving market needs. Moreover, the fourth industrial revolution intensifies structural unemployment, necessitating proactive strategies for skill development and lifelong learning.

Types of Unemployment

Frictional Unemployment

Frictional unemployment emerges during periods of voluntary job transitions. Individuals, driven by career advancement or improved opportunities, temporarily exit the workforce, contributing to frictional unemployment. However, this form of unemployment is often short-lived as individuals eventually secure positions better suited to their skills and aspirations.

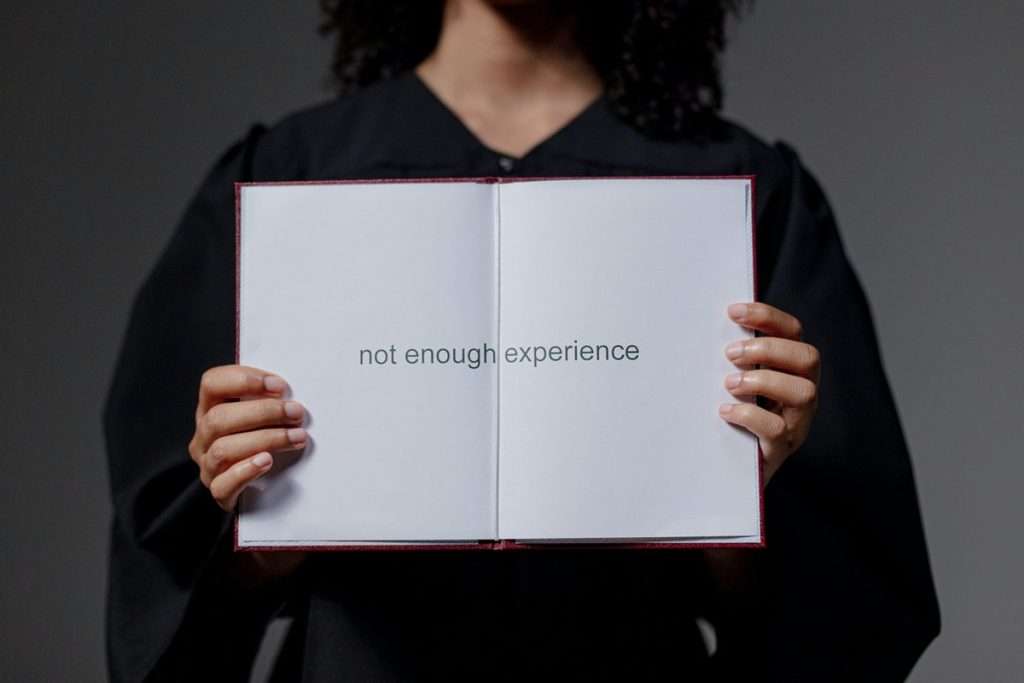

Structural Unemployment

Structural unemployment arises from a mismatch between the skills possessed by the workforce and the demands of available jobs. Technological advancements and shifts in industry requirements can create skill gaps, leaving workers unemployed until they acquire relevant skills. This form of unemployment necessitates comprehensive workforce development programs to bridge the gap between skills and market needs.

Cyclical Unemployment

Cyclical unemployment is intrinsically tied to the economic cycle. It increases during economic downturns, as reduced consumer spending prompts businesses to downsize their workforce. Conversely, during periods of economic growth, cyclical unemployment decreases as demand for labor increases. Policymakers must focus on economic stabilization measures to mitigate the adverse impacts of cyclical unemployment.

Seasonal Unemployment

Seasonal unemployment is a result of predictable fluctuations in labor demand across different times of the year. Industries such as agriculture and tourism often experience seasonal variations in employment due to factors like weather and holiday seasons. While seasonal unemployment is temporary, it underscores the importance of diverse skill sets for individuals to remain employable throughout the year.

Unemployment’s Ripple Effects

Impact on Consumer Spending

High unemployment curtails disposable income, leading to reduced consumer spending. This downturn in spending ripples through the economy, affecting businesses and potentially leading to further layoffs. Reduced consumer confidence exacerbates the situation, creating a cycle of decreased spending and economic contraction. Policymakers must navigate this complex interplay to restore consumer confidence and stimulate economic recovery.

Government Expenditures and Taxes

Unemployment places a significant burden on government resources. It necessitates increased spending on unemployment benefits, social welfare programs, and healthcare services. Additionally, governments may experience reduced tax revenues due to lower economic activity, making it challenging to maintain public services without compromising fiscal stability.

Income Inequality

Unemployment exacerbates income inequality within societies. Those who lose their jobs often face financial distress, whereas employed individuals enjoy stable incomes. This inequality can lead to societal unrest and hinder social mobility. Policymakers should prioritize inclusive economic policies and support mechanisms to alleviate income disparities and promote equitable opportunities.

Unemployment Rates Across Economies

Global Comparisons

Unemployment rates vary globally due to diverse economic conditions, labor market regulations, and government policies. Cross-country comparisons offer valuable insights into the effectiveness of different approaches in managing and reducing unemployment. These comparisons facilitate the identification of best practices that can be adapted to specific national contexts.

Regional Disparities

Unemployment rates can significantly differ within a country due to variations in job opportunities and economic development between urban and rural areas. Urban centers often offer a wider range of job prospects, whereas rural areas may face limited employment options, highlighting the need for targeted regional development initiatives.

Measuring and Interpreting Unemployment Rates

Labor Force Participation Rate

The labor force participation rate provides a holistic view of the proportion of the working-age population actively engaged in seeking employment. Fluctuations in this rate offer insights into workforce dynamics, such as individuals entering or leaving the job market due to economic conditions or personal factors.

Natural Rate of Unemployment

The natural rate of unemployment represents the equilibrium level of unemployment consistent with stable inflation rates. Deviations from this rate can signal potential economic imbalances, underscoring the importance of policies that align actual unemployment rates with the natural rate.

Demographic Considerations

Unemployment rates vary among demographic groups, including age, gender, ethnicity, and education level. Analyzing these disparities provides a comprehensive understanding of labor market dynamics and helps policymakers tailor interventions to address specific challenges faced by various segments of the population.

Government Policies and Interventions

Unemployment Benefits

Unemployment benefits provide a safety net for jobless individuals, offering financial support during periods of unemployment. These benefits not only alleviate immediate financial strain but also contribute to economic stability by sustaining consumer spending during economic downturns.

Training and Skill Development Programs

Investing in education and skill development is essential to equip the workforce with the tools needed to thrive in evolving job markets. Reskilling initiatives ensure that individuals can adapt to changing skill requirements, reducing the risk of prolonged unemployment due to technological shifts.

Stimulus Packages

During economic downturns, governments often deploy stimulus packages to boost economic activity and create jobs. These interventions aim to mitigate the adverse effects of unemployment by fostering consumer spending, supporting businesses, and facilitating job creation in critical sectors.

Forecasting Unemployment Trends

Analytical Approaches

Economists utilize various analytical approaches to forecast unemployment trends. These approaches incorporate a wide range of economic variables, including GDP growth, inflation rates, technological advancements, and geopolitical factors. By assessing these variables, economists can develop predictive models that offer insights into future unemployment scenarios.

Economic Projections

Economic research institutions provide projections on future unemployment rates based on anticipated economic conditions and potential policy changes. These projections serve as valuable tools for policymakers, businesses, and individuals seeking to understand and prepare for potential shifts in the job market.

Strategies for Mitigating Unemployment

Promoting Job-Creation Sectors

To combat unemployment, policymakers can prioritize job-creation sectors, such as technology, renewable energy, healthcare, and infrastructure. By offering incentives and support to businesses operating in these sectors, governments can stimulate job growth and economic vitality.

Investing in Education and Innovation

Education and innovation are powerful tools for reducing unemployment. Governments and educational institutions can collaborate to develop programs that align education with industry demands. This approach ensures that individuals acquire skills that are relevant and valuable in the evolving job landscape.

Supporting Small Businesses

Small businesses are essential drivers of job creation and economic growth. Governments can provide targeted support through grants, low-interest loans, and mentoring programs. By fostering an environment conducive to small business success, policymakers contribute to employment opportunities and community development.

Case Studies: Unemployment’s Economic Impact

Recession-Driven Unemployment Spikes

Historical instances of economic recessions underscore the significant impact of unemployment spikes on overall economic health. These cases highlight the urgency of implementing effective policy responses that safeguard jobs, support businesses, and facilitate recovery during challenging economic periods.

Successful Employment Recovery Strategies

By analyzing successful instances of employment recovery, policymakers can identify strategies that mitigate the effects of unemployment. These strategies may include targeted stimulus packages, investment in job-training programs, and collaboration between government, industry, and education sectors.

Conclusion

Understanding the intricate interplay between unemployment rates and economic health is essential for policymakers, businesses, and individuals alike. By comprehensively exploring the dynamics of unemployment, including its causes, consequences, and potential solutions, society can work collaboratively to foster a more stable, equitable, and resilient economic landscape.